All Categories

Featured

Table of Contents

According to SEC authorities, existing CDAs have been registered as safeties with SEC, and for that reason are covered by both federal securities laws and regulations, and state insurance policy laws. At the state degree, NAIC has actually developed state disclosure and suitability policies for annuity products. Nevertheless, states differ on the degree to which they have adopted these annuity guidelines, and some do not have securities whatsoever.

NAIC and state regulators informed GAO that they are currently examining the regulations of CDAs (500 000 annuity income). In March 2012, NAIC started assessing existing annuity guidelines to figure out whether any type of changes are needed to attend to the special product layout features of CDAs, including possible alterations to annuity disclosure and viability criteria. It is additionally assessing what type of funding and booking demands may be required to assist insurance providers manage product threat

Guaranteed Fixed Annuity

Both agree that each state will certainly have to reach its very own verdict regarding whether their particular state guaranty fund regulations enable CDA insurance coverage. Till these regulative concerns are fixed, customers might not be completely safeguarded. As older Americans retire, they may encounter increasing health and wellness treatment expenses, inflation, and the danger of outlasting their properties.

Life time earnings items can aid older Americans ensure they have revenue throughout their retired life. VA/GLWBs and CDAs, 2 such products, might give distinct benefits to customers. According to sector individuals, while annuities with GLWBs have been sold for a variety of years, CDAs are reasonably brand-new and are not commonly offered.

GAO supplied a draft of this record to NAIC and SEC (guaranteed lifetime income annuity calculator). Both offered technical remarks, which have actually been attended to in the report, as proper. To learn more, call Alicia Puente Cackley at (202) 512-8678 or

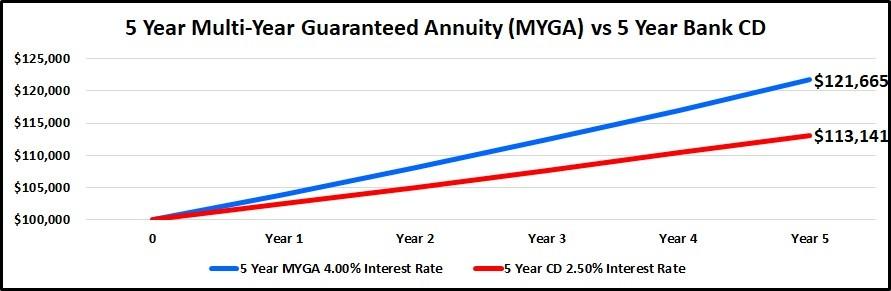

It assures a set rate of interest price each year, no matter what the stock exchange or bond market does. Annuity guarantees are backed by the financial strength and claims-paying capability of American Savings Life Insurance Policy Firm. Protection from market volatility Assured minimal rate of interest Tax-deferred cash accumulation Ability to stay clear of probate by assigning a recipient Alternative to transform part or all of your annuity into an income stream that you can never ever outlive (annuitization) Our MYGA offers the very best of both worlds by ensuring you never lose a dime of your primary financial investment while concurrently ensuring a passion price for the selected amount of time, and a 3.00% guaranteed minimum interest price for the life of the contract.

The rates of interest is guaranteed for those abandonment fee years that you pick. We have the ability to pay above-market rate of interest because of our below-average expenses and sales expenses as well as our consistent above-average economic efficiency. 1-Year MYGA 5.00% 2-Year MYGA 5.25% 3-Year MYGA 5.25% 4-Year MYGA 5.25% 5-Year MYGA 5.25% 10% Yearly Penalty-Free Withdrawal Biker (no charge) Penalty-Free Survivor benefit Motorcyclist (no price) Penalty-Free Persistent Ailment Biker (no charge) Penalty-Free Terminal Illness Cyclist (no charge) Penalty-Free Assisted living home Arrest Rider (no charge) Multi-Year Surefire AnnuityAn Person Single Costs Fixed Deferred Annuity Rate Of Interest Price Options(Rate of interest differ by thenumber of years picked) 1-Year: 1-year abandonment charge2-Years: 2-years surrender charge3-Years: 3-years give up charge4-Years: 4-years give up charge5-Years: 5-years surrender fee Issue Ages 18-95 years old: 1 or 2 years durations18-90 years of ages: 3, 4, or 5 years durations Concern Age Resolution Current Age/ Last Birthday Celebration Minimum Costs $25,000 Maximum Premium $500,000 per specific Rate Lock Allowances For circumstances such as individual retirement account transfers and IRC Area 1035 exchanges, an allowance might be made to lock-in the application day interest rateor pay a greater rates of interest that may be readily available at the time of concern.

Withdrawals are subject to normal income tax obligations, and if taken prior to age 59-1/2 might sustain an additional 10% federal fine. Neither American Savings Life nor its producers offer tax obligation or legal guidance.

Annuity Cash Value

These payment prices, which include both passion and return principal. The rates represent the annualized payout as percent of total costs. The New York Life Clear Earnings Advantage Fixed AnnuityFP Collection, a set postponed annuity with a Surefire Lifetime Withdrawal Benefit (GLWB) Biker, is provided by New York Life Insurance and Annuity Company (NYLIAC) (A Delaware Firm), a completely possessed subsidiary of New York Life Insurance Firm, 51 Madison Avenue, New York, NY 10010.

All warranties are reliant upon the claims-paying capability of NYLIAC. There is a yearly cyclist fee of 0.95% of the Accumulation Worth that is subtracted quarterly. Based on the life with money refund alternative, male annuitant with $100,000.

An assured annuity price (GAR) is a promise by your pension plan carrier to provide you a certain annuity price when you retire.

New York Life Annuity Rates

That can make a huge distinction to your retired life revenue. Certainly, that's not always the situation. For example, if you have actually obtained health issue you may be eligible for an improved annuity, which can likewise offer you a better price than you 'd typically obtain. And your guaranteed annuity could not consist of attributes that are essential to you.

An assured annuity rate is the rate that you get when you acquire an assured annuity from your supplier. This influences just how much income you'll obtain from your annuity when you retire. It's excellent to have actually an assured annuity rate because maybe much greater than existing market rates.

Surefire annuity rates can go as high as 12%. That's about dual the best rates you'll see on the market today.

New York Life Annuity Rates Today

If you choose to transfer to a flexi-access pension, you may require to speak to a financial advisor. There might likewise be constraints on when you can set up your annuity and take your assured rate.

It's an information that usually gets buried in the fine print. immediate income annuity. Your service provider might call it something like a 'retirement annuity contract', or describe a 'Area 226 policy', or just speak about 'with-profits', 'advantages', 'advantageous' or 'assure' annuities. So to locate out if you've obtained one, the most effective thing to do is to either ask your supplier directly or consult your monetary advisor.

An annuity assurance period is extremely various from an ensured annuity or guaranteed annuity price. This is a fatality benefit choice that changes your annuity settlements to a liked one (normally a companion) for a certain amount of time approximately 30 years - when you die. An annuity assurance period will give you assurance, however it likewise suggests that your annuity income will certainly be a little smaller.

If you pick to transfer to one more supplier, you may lose your guaranteed annuity price and the benefits that come with it. Yes - annuities can come with a number of various kinds of guarantee.

Income From Annuity Calculator

As you can imagine, it's simple to mention an ensured annuity or an assured annuity rate, meaning a surefire earnings or annuity guarantee period. Assured annuity rates are in fact extremely different from them.

Table of Contents

Latest Posts

Highlighting Pros And Cons Of Fixed Annuity And Variable Annuity A Comprehensive Guide to Investment Choices Breaking Down the Basics of Investment Plans Features of Smart Investment Choices Why Choos

Understanding Financial Strategies Key Insights on Your Financial Future Breaking Down the Basics of Variable Vs Fixed Annuities Features of Smart Investment Choices Why Choosing the Right Financial S

Analyzing Strategic Retirement Planning Everything You Need to Know About Fixed Annuity Vs Variable Annuity What Is the Best Retirement Option? Advantages and Disadvantages of Indexed Annuity Vs Fixed

More

Latest Posts